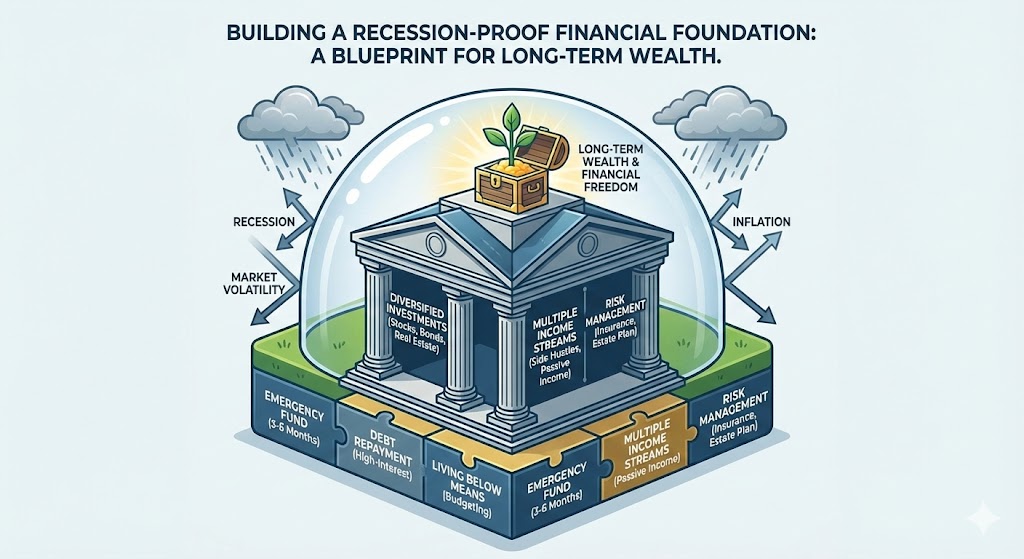

Building a Recession-Proof Financial Foundation

In an era of fluctuating markets, rising inflation, and global economic shifts, the concept of “financial security” has evolved. It is no longer enough to simply have a steady paycheck. True financial freedom comes from building a resilient foundation that can withstand external shocks while consistently growing over time.

This guide breaks down the essential pillars of modern personal finance, moving from basic survival to sophisticated wealth building.

1. The Psychology of Money: Mindset Over Mathematics

Before touching a spreadsheet, you must understand your relationship with money. Most financial failures aren’t due to a lack of math skills; they are due to emotional triggers.

-

Delayed Gratification: The ability to prioritize your “future self” over “current impulses” is the single greatest predictor of wealth.

-

The Comparison Trap: In the age of social media, “lifestyle creep” (increasing your spending as your income rises) is a primary wealth-killer.

To build wealth, you must decouple your self-worth from your spending habits.

2. Mastering the Cash Flow: The 50/30/20 Rule

Budgeting often feels restrictive, but it is actually a tool for freedom. If you don’t know where your money is going, you cannot direct it toward your goals. A classic, effective framework is the 50/30/20 Rule:

-

50% for Needs: Housing, utilities, groceries, and insurance.

-

30% for Wants: Dining out, hobbies, and entertainment.

-

20% for Financial Goals: Debt repayment, emergency funds, and investments.

The Fortress: Emergency Funds and Insurance

The first step in any financial plan is defense. Without a safety net, one medical emergency or job loss can wipe out years of progress.

The Emergency Fund

Target 3 to 6 months of essential living expenses. This money should stay in a High-Yield Savings Account (HYSA). It isn’t meant to “grow”; it is meant to provide “liquidity” and peace of mind.

Risk Management (Insurance)

You cannot build a skyscraper on a swamp. Ensure you have:

-

Term Life Insurance: To protect dependents.

-

Health Insurance: To prevent bankruptcy from medical bills.

-

Disability Insurance: To protect your greatest asset—your ability to earn an income.

4. Attacking High-Interest Debt

Not all debt is created equal. Toxic debt, such as credit card balances with 20%+ interest rates, is a financial emergency. It compounds against you faster than most investments can grow for you.

-

The Avalanche Method: Pay off the highest interest rate first to save the most money.

-

The Snowball Method: Pay off the smallest balance first for psychological “wins.”

Whichever method you choose, the goal is the same: eliminate high-interest liabilities so your capital can be redirected into assets.

5. The Engine of Growth: Investing for the Future

Once your defense is set, it’s time to play offense. Investing is the process of making your money work for you so that eventually, you don’t have to work for it.

The Power of Compounding

Compound interest is often called the “eighth wonder of the world.” Small amounts invested consistently in your 20s or 30s will far outperform large amounts invested in your 50s.

Asset Allocation

A diversified portfolio reduces risk. A typical balanced portfolio includes:

-

Equities (Stocks): For long-term growth.

-

Fixed Income (Bonds): For stability and income.

-

Real Estate/Commodities: For inflation protection.

6. Understanding Tax Efficiency

It’s not about how much you make; it’s about how much you keep. Utilizing tax-advantaged accounts is a legal way to accelerate your wealth.

-

Retirement Accounts: Depending on your country, use vehicles like the 401(k), IRA, or ISA. These allow your investments to grow tax-free or tax-deferred.

-

Tax-Loss Harvesting: Selling losing investments to offset gains, thereby reducing your tax bill.

7. Diversifying Income Streams

In the modern economy, a single source of income is a single point of failure. The wealthiest individuals typically have at least three streams of income:

-

Earned Income: Your day job.

-

Passive Income: Dividends from stocks or rental income from property.

-

Side Hustles/Business Income: Monetizing a skill or hobby.

Digital leverage (creating content, software, or online courses) has made it easier than ever to build secondary income streams with low overhead.

8. Inflation: The Silent Eroder

Inflation reduces the purchasing power of your cash over time. If you keep all your savings under a mattress or in a 0.01% interest checking account, you are effectively losing money every year.

To beat inflation, you must own appreciating assets. Historically, the stock market and real estate have been the most reliable hedges against the rising cost of living.

9. The Importance of Financial Literacy

The financial world is designed to be confusing so that institutions can charge high fees. Education is your best defense.

-

Avoid “Get Rich Quick” Schemes: If it sounds too good to be true, it’s a scam.

-

Keep Fees Low: High management fees on mutual funds can eat up to 30% of your gains over 30 years. Opt for low-cost Index Funds or ETFs.

10. Review and Rebalance

A financial plan is not a “set it and forget it” document. Life changes—you might get married, have children, or change careers.

-

Annual Review: At least once a year, check your net worth and rebalance your portfolio to ensure your risk level matches your goals.

-

Adjust for Inflation: Increase your automated savings contributions whenever you get a raise.

Conclusion: The Path Forward

Building a recession-proof financial life isn’t about luck; it’s about discipline and systems. By protecting yourself with an emergency fund, eliminating toxic debt, and consistently investing in a diversified portfolio, you create a trajectory toward true independence.

The best time to start was ten years ago; the second best time is today. Financial freedom is a marathon, not a sprint. Focus on the process, remain patient, and let the power of time do the heavy lifting.