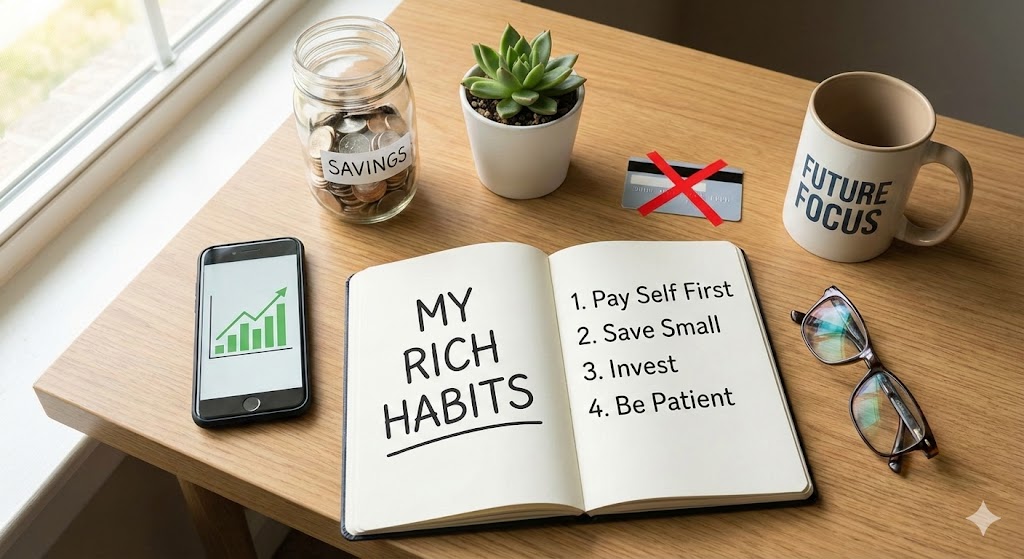

Simple Habits that Make You Rich: A Guide to Financial Freedom

Building wealth is not a secret. You don’t need to be born into a rich family or win the lottery. Most people who become wealthy do it by following small, simple habits every day. If you can manage your daily habits, you can manage your future.

In this article, we will talk about the easy steps you can take today to change your financial life forever.

1. Pay Yourself First

Most people get their salary, pay their bills, buy groceries, spend on fun, and then save whatever is left. The problem? Usually, nothing is left.

To get rich, you must flip this. As soon as you get your money:

-

Put a small amount (like 10%) into savings.

-

Then pay your bills.

-

Spend what is left after that.

This is called “Paying Yourself First.” It ensures that your future is always a priority.

2. The Power of “Small Wins.”

We often think saving $5 is useless. But small amounts add up fast.

-

The Coffee Math: If you spend $5 on a coffee every workday, that is $100 a month. In a year, that is $1,200.

-

The Investment Math: If you invest that $1,200 at 10% interest, in 30 years, it could grow to over $200,000.

Don’t ignore the small coins. Every dollar is a “seed” that can grow into a tree.

3. Understand “Inflation” (The Price Thief)

Have you noticed that bread or milk costs more today than it did five years ago? This is called Inflation.

If you keep all your money in a box under your bed, it loses value. In ten years, that money will buy fewer things. To fight this “thief,” you must put your money where it can grow faster than inflation—like in a business, real estate, or the stock market.

4. Spend Money on “Assets,” Not “Liabilities”

This is the most important rule in finance.

-

An Asset puts money into your pocket (like a rental house or stocks that pay dividends).

-

A Liability takes money out of your pocket (like a car that needs petrol and repairs, or expensive clothes).

Rich people buy assets first. Poor people buy liabilities and think they are assets. Before you buy something, ask: “Will this make me money, or will it cost me money?”

5. Avoid “Impulse Buying.”

Companies spend billions of dollars on ads to make you buy things you don’t need. This is “Impulse Buying.”

The Rule of Three: 1. Do I need it?

2. Can I afford it?

3. If I wait three days, will I still want it?

If the answer to any of these is “No,” don’t buy it. This one habit can save you thousands of dollars every year.

6. Use the “Rule of 72.”

Want to know how long it takes to double your money? Use this simple math trick.

Divide 72 by the interest rate you are getting.

-

If you get 10% interest: $72 / 10 = 7.2$ years. Your money doubles in about 7 years.

-

If you get 2% interest: $72 / 2 = 36$ years.

This helps you see why finding a good place to grow your money is so important.

7. Don’t Try to “Look” Rich

There is a big difference between looking rich and being rich.

-

Looking rich: Driving a fancy car you can’t afford and wearing designer brands while having a zero bank balance.

-

Being rich: Having a large bank account and investments, even if you drive an old car.

Most millionaires live in middle-class neighborhoods and drive normal cars. They stay rich by not spending all their money on “showing off.”

8. Surround Yourself with the Right People

There is a saying: “You are the average of the five people you spend the most time with.” If your friends always talk about spending money and going to parties, you will do the same. If your friends talk about business, goals, and saving, you will start thinking like them. Choose your circle wisely.

9. Create Multiple “Fountains” of Income

Relying on only one job is risky. What if the company closes?

Try to create different “fountains” of money:

-

Your Job: Your main income.

-

A Side Hustle: Selling something online or freelancing.

-

Investments: Money that grows while you sleep.

Even a small side income of $50 a week can change your life over time.

10. Stay Patient

The biggest enemy of wealth is impatience. Everyone wants to be rich tomorrow. But real wealth is built slowly.

Think of it like planting a garden. You can’t pull the plants to make them grow faster. You just have to water them, give them sun, and wait. Finance is exactly the same. Be patient, stay consistent, and the results will come.

Conclusion: Your Journey Starts Now

You don’t need a lot of money to start. You just need a plan.

-

Start saving today, even if it’s just $1.

-

Stop buying things to impress people you don’t like.

-

Learn something new about money every week.

If you follow these simple habits, you will not just “survive” financially—you will thrive. Your future self will thank you for the choices you make today.